Your Complete Guide to Calculate Stripe Processing Fees with the Stripe Fee Calculator

Table of Contents

- Introduction

- Deciphering the Fees That Stripe Charges

- Standard Processing Rates

- Additional Fees to Consider

- Why Utilize a Stripe Processing Fees Calculator?

- Make Better Financial Decisions

- Eliminate Complex Calculations

- Manual Calculation of Stripe Processing Fees

- How to Use the ConverterUp Stripe Fee Calculator

- Tips to Reduce Processing Fees on Payments With Stripe

- Common Mistakes when Performing Stripe Fee Calculations

- Frequently Asked Questions

Introduction

Are you fed up with Stripe processing fees cutting into your profits without warning? You're not alone; many business owners struggle to know when they will be charged for transactions or how to price their products accordingly. This makes it almost impossible to accurately forecast revenue or even know your actual profit margin! Stripe processing fees are a vital aspect of any online business taking customer payments. From digital products to subscription businesses to e-commerce websites, knowing your exact processing costs can help you make better business decisions.

This guide will help make sense of everything you need to know about Stripe's fees, as well as show you how to use and/or build a reliable stripe processing fees calculator to organize the numbers. At the end of this guide, you'll have all the knowledge and tools you need to calculate Stripe fees like a pro!

Deciphering the Fees That Stripe Charges

Although Stripe's pricing may seem simple at first glance, initially familiarizing yourself with it can be confusing. Let's take some time to get into it so you will really have knowledge of what they charge.

Standard Processing Rates

For most online processing to customers in the United States, Stripe charges its standard practice, which is 2.9% + 30¢ fees. Although simple at face value, your fees will differ for the following reasons:

- Different card types: Credit vs. debit cards

- Involved processing method: Online vs. in-person payments

- Volume of business: Higher volume businesses may qualify for custom rates

- International transactions: Fees apply if you are using foreign cards

Additional Fees to Consider

In addition to standard processing fees, Stripe will charge additional fees in some scenarios.

1) International card fees. Extra fee of 1% on cards issued outside of the US

2) Currency conversion fees. An additional 1% fee for all transactions completed in non-USD currencies

3) Chargeback fees. You may be charged a $15 fee on each disputed charge, which the bank/merchant feels is a fraudulent transaction.

4) Radar fraud protection fees. Costs will be added depending upon what protection services you enroll for.

Understanding these various fees is essential for making accurate calculations. Here is where a Stripe Fee Calculator can help out greatly with your business expectations.

Why Utilize a Stripe Processing Fees Calculator?

For many business owners processing hundreds (or thousands) of payments each month, manually calculating Stripe fees for each transaction is impractical. Here are three key reasons savvy business owners use a Stripe processing fees calculator.

Save Time and Avoid Mistakes

Using a stripe processing fees calculator removes any estimation and potential errors in the calculations. Instead of calculating percentages and adding fixed fees manually, you enter the amount of the transaction, and the calculator will instantly show you the total fee, including tax.

Make Better Financial Decisions

When you know exactly how much you will pay for each transaction, you are better able to:

- Price your products accurately

- Estimate your net revenue better

- Make better comparisons between payment processors

- Budget for payment processing costs

Eliminate Complex Calculations

Today's calculators can accommodate many more situations that can be tedious to calculate manually, including the following:

- Multiple transactions at once

- International payment fees

- Card types and card regions

- Rate adjustments Based on volumes

Manual Calculation of Stripe Processing Fees

While a calculator is much easier to use, understanding how to do the calculations manually will help you understand how Stripe charges for your processing.

Basic Fee Calculation Formula

For a typical transaction in the US, it is simple:

Processing fee = (Transaction total x 2.9%) + 0.30

Walkthrough Example

Let's find out the fee for a $100 sale:

- Find out percentage fee: $100 x 2.9% = $2.90

- Add-on fixed fee: $2.90 + 0.30 = $3.20

- Total processing fee will be $3.20.

- Amount you receive will be $100 - $3.20 = $96.80

The problem gets more complex if you have an international sale.

International example for $100 sale:

- Standard fee: ($100 x 2.9%) + 0.30 = $3.20

- International fee: $100 x 1% = $1.00

- Total Processing Fee: $3.20 + $1.00 = $4.20

- Amount you receive: $100 - $4.20 = $95.80

As you can see, as the transaction amounts and types of transaction get more complicated, the math starts to get complicated, and this is why you should be using our Stripe Fee Calculator for instant and accurate results!

How to Use the ConverterUp Stripe Fee Calculator

Our free Stripe Fee Calculator makes this process easier than ever and gives you accurate results within seconds! Here are some details about how it works and why it is a smart option for your business.

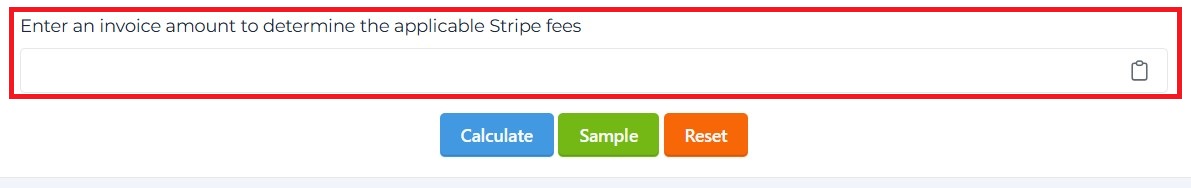

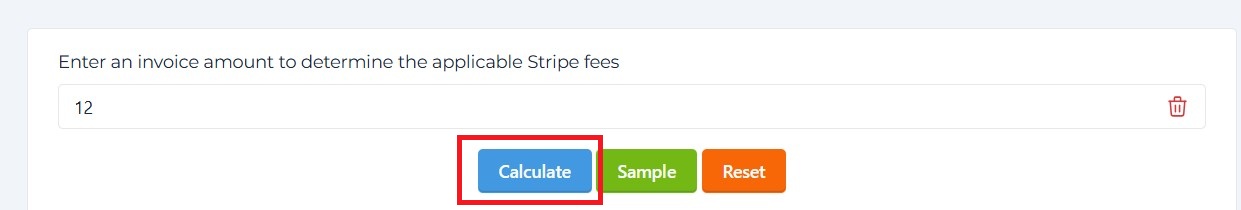

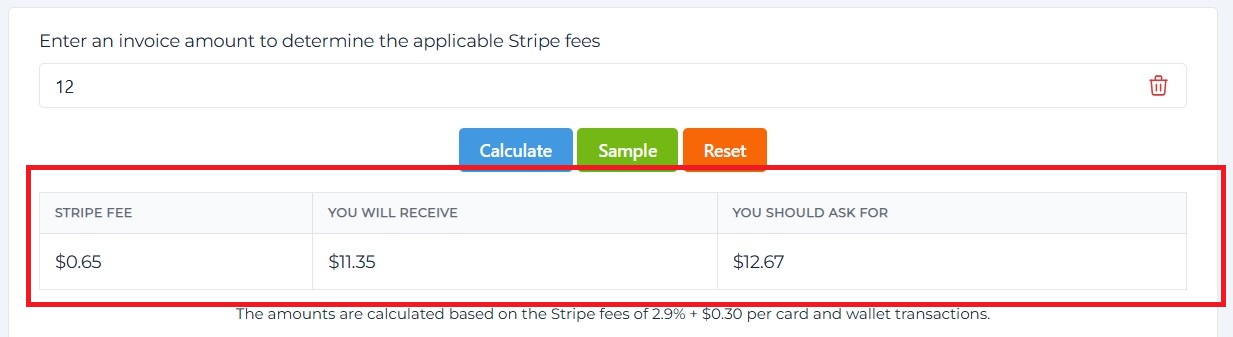

1. Go to the Stripe fee calculator.

2. Enter the transaction amount

3. Click the Calculate Button.

4. View Final Result.

The tool applies the Stripe rates automatically, calculates with broken-down fees, and gives you both exactly how much you will pay and how much you will be paid after processing fees. How to Use Stripe Fee Calculator

The Features

The ConverterUp summary calculator has many benefits:

- It gives instant calculations for any transaction amount

- It supports international fees and currency conversions

- You can use bulk options to calculate multiple transactions

- You do not need to register for an account—it is free to use!

- The tool is mobile-friendly, so you can do the calculations on-the-go, which gives you flexibility

Enhanced Features

If your business has more comprehensive needs, then our calculator also has

- Multiple transaction processing

- Historical fee tracking

- Export options available for record keeping

- Ability to input your own rates due to negotiated pricing

Want to find out more about using the calculator to its full potential? Take a look at our full documentation on how to use the Stripe Fee Calculator for advanced features.

Factors that influence your processing fees.

There are several factors that can influence your final Stripe processing fees, and understanding these elements will help you optimize your payment strategy and save on processing fees.

Transaction volume.

Higher processing volumes usually translate into better rates.

- Standard accounts, you will have a fixed rate of 2.9% +30¢.

- High-volume (higher processing volume) accounts are more likely to be offered custom pricing.

- Enterprise accounts may have fully negotiated rates based on their projected volume.

Geographical Considerations

If the location of your customer base will influence fee significantly

- Domestic cards are standard rates

- International cards and the additional 1%

- European customers and rates and structures specific to the EU

Business Type and Risk Profile

Stripe is guided by many business considerations:

- Risk level of the industry

- The previous industry's chargeback experience

- Transaction patterns

- Overall age of business

Payment Method Variation

Payment Methods will have different cost structures:

1. Credit card: standard rates

2. Debit card: tends to have lower fees

3. Digital wallet: may have different structures

4. Bank transfers: different fee structures altogether

Tips to Reduce Processing Fees on Payments With Stripe

Smart business owners are vigilant about finding legitimate ways to cut costs on payment processing fees. Here are a few techniques that work.

Make your pricing strategy work for you

As tempting as it may be to take the fee cost on board, it is much better to build the fees into your prices. Things to consider include:

- Adding a small processing fee to reflect the costs

- Offering discounts for lower payment method costs

- Establishing minimum order amounts to increase the fee ratio

Encourage the more affordable method of payments

In some instances, you will pay less for payment processing as some methods are less expensive to pay

- ACH transfers have lower fees when sent in larger amounts

- Debit Cards are often cheaper to process than credit cards

- Bank transfers: there is little cost to processing

Lower Chargebacks and Disputes

Chargebacks are costly ($15 each with Stripe), so prevention is key:

- Clear product descriptions reduce confusion

- Great customer service helps prevent disputes

- Fast shipping & communication helps with satisfaction

- Fraud prevention checks can help protect from fraudulent charges

Monitor International Transactions

International card fees can become expensive. To avoid confusion:

- Look to use local payment processors, if you are in international markets

- Clear communications displaying prices in local currencies

- Understanding what % of your customers are international

Common Mistakes when Performing Stripe Fee Calculations

Even seasoned business owners can miscalculate fees that would impact their profit. Here are some common mistakes to avoid.

Forgetting the Fixed Fee

Many will only see the percentage (2.9%) and forget about the 30¢ fixed fees per transaction! This is incredibly important to consider on smaller transactions.

Not Paying Attention to International Fees

The extra 1% international card fee comes as a surprise to many businesses. You should factor this into the pricing for international customers.

Not Accounting for Chargebacks

Chargeback fees ($15 each) aren't usually an included part of payment processing costs. However, in fact, they can have a large impact on the overall payment expenses of some businesses.

Miscalculating Your Net Revenue

Don't forget fees come out of the gross transaction amount. A $100 sale does not net you $97.10 ($100 - $2.90). Considering the fixed fee, a $100 transaction should have been $100 - $3.20 = $96.80.

Frequently Asked Questions

1. How much does Stripe take?

For standard online transactions, Stripe charges 2.9% + 30¢ if you are operating in the US. To accept an international card, Stripe charges an extra 1% fee on top of these fees depending on your country. An example of a fee cost will depend on what you are doing for your business, including the volume of transactions, your country, and the type of business you are operating.

2. Can I reduce my Stripe fees?

Yes! There are a few ways you can reduce your Stripe costs. You can negotiate a custom rate, which is possible once you reach a certain threshold of transactions in volume; choose payment methods that are lower cost, for example, ACH/Bank payments; minimize chargebacks by providing great service (great service = happy customers, etc.); and most importantly, identify ways to account for transaction costs when you develop your pricing strategy.

3. Is there a free Stripe fee calculator?

Yes! ConverterUp offers a completely free Stripe Fee Calculator with no sign-up or registration required. You can easily use it to quickly and accurately calculate any fees when accepting Stripe payments, for both domestic and international transactions. Using the fee calculator can also help you when you are trying to plan your pricing and revenue forecasts.

4. What is the difference between Stripe's online and in-person rates?

Stripe charges online rates of 2.9% + 30¢ and in-person rates of 2.7% + 5¢ when a customer pays via one of their card readers. Online rates are higher than in-person rates because there is a lower risk of fraud associated with in-person transactions.