How to Use Margin Calculator Tool

Table of Contents

- Introduction

- What is a Margin Calculator?

- Why Profit Margin Calculation is Important

- How to Use Our Margin Calculator

- Why Use a Margin Calculator?

- How does the Margin Calculator work?

- When do you calculate profit margin?

- Different Types of Margin Calculators

- Other Metrics to Monitor In Addition to Your Margin

- Margin Calculator for Small Businesses

- How a Margin Calculator Assists in Pricing Decisions

- FAQs

Introduction

Profit margins are an important part of any business owner or entrepreneur's business. Retail, Manufacturing and Services Industries Regardless of whether you are in retail, manufacturing, or service sectors, knowing how much profit you make on each product or service can have a great impact on decision-making. But what if calculating the information did not require complicated spreadsheets or manual computations and was instead a quick, painless process?

That’s where a margin calculator comes in. This basic form makes it easy to calculate your profit margin in seconds and then be able to see a summary of some of your business’s profitability in one section of a page. In this post, we’ll walk through what a margin calculator is, why it matters for your business’s bottom line, and how to use our margin calculator tool to quickly make financial business decisions.

What is a Margin Calculator?

What is a Margin Calculator? It’s used to calculate your profit margin, which is the difference between what you pay to produce or buy an item and what you charge to sell it.

Think of it as the business profitability’s equivalent of a snapshot. With knowledge of the profit margin, you could better calculate pricing, costs, and overall business strategy. It is a key instrument for anyone running a business, no matter how large or small.

Why Profit Margin Calculation is Important

If that’s the case, computing your profit margin is one of the best things that you can do to help grow and maintain a healthy and profitable business. Here’s why:

- Pricing Strategy: If you can’t afford to make less, maybe your pricing model is outdated and needs to be adjusted for inflation.

- Tracking Financial Health: Profit margin can be used to measure your business’s financial health. Falling margins, by contrast, over the course of time could be an indication of cost or pricing pressure.

- Running Your Business More Profitably: Once you understand your margin, you will be in a better position to figure out how to manage your production costs more effectively, keep overhead under control, and explore other options to help you be more efficient in your business.

How to Use Our Margin Calculator

We have created a calculator that is easy to use and very simple. Here's how to use it:

Step 1: Visit The Tool

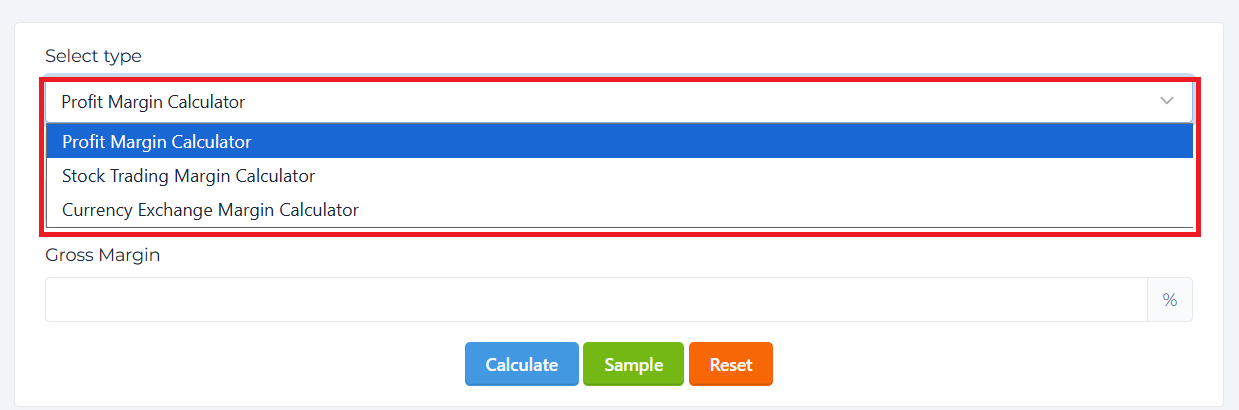

Step 2: Select the type.

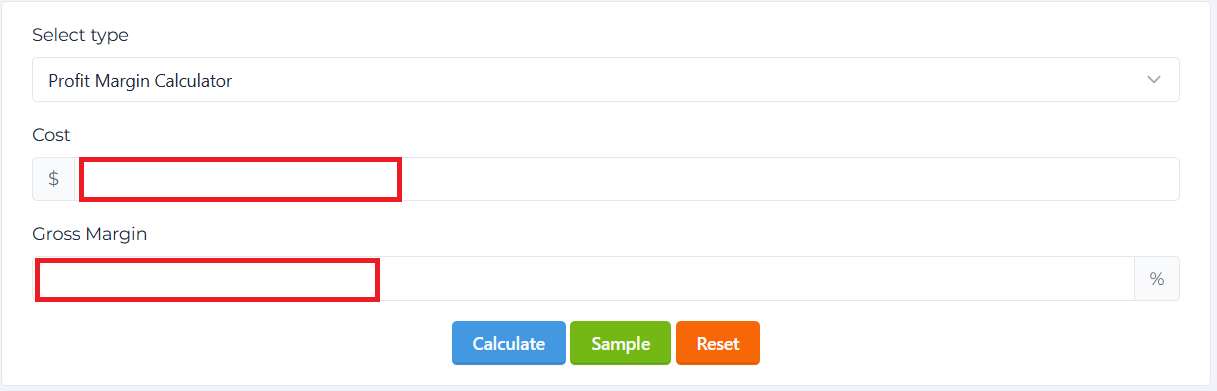

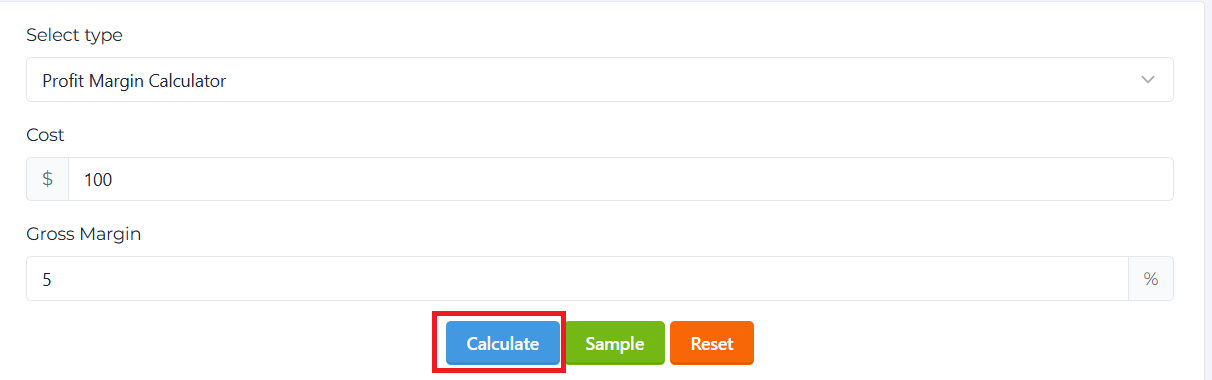

Step 3: Enter the Cost and Gross Margin.

Step 4: Click The Calculate Button.

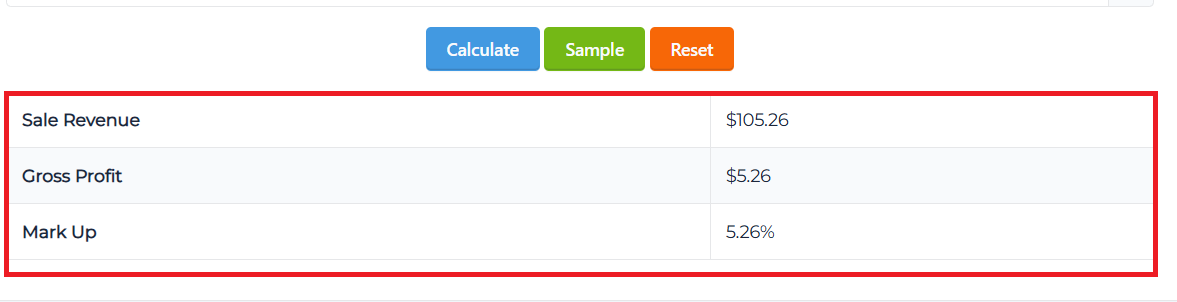

Step 5: View the Result.

Why Use a Margin Calculator?

There are several benefits of employing a margin calculator, so we will discuss them.

- Speed: It takes seconds to calculate your profit margins for you, which is unlike doing it manually.

- Precision: Minimize the potential for errors associated with manual margin calculations, and get accurate results every time.

- Convenience: That makes it easier to set or change prices on a whim when you can easily see your margins and work from there.

- Better Financial Management: Understanding your margins allows you to spot waste or lost profit and make decisions that increase profitability.

How does the Margin Calculator work?

And our margin calculator is extremely accurate. It was intended to give you an accurate response with respect to the data you give it. The tool’s equation is simple but efficient, and it’s the very equation that professionals working in accounting and finance use.

Just bear in mind that the calculator is only as accurate as the information you are plugging into it.

When do you calculate profit margin?

You should determine your profit margin any time you have:

- New product launching: But before you put a product on the shelf, know how much you’ll stand to make a profit.

- Adjusting Prices: Before you adjust your rates, figure out how it will impact your margin.

- Reading Your Margin: Do the math on margins for profit Into quarterly profit or loss.

- Analyze Your Financials: After closing out your books, review your margin to have a sense of how the business is performing.

Different Types of Margin Calculators

There are multiple types of margin calculators depending on the metrics you want. The most common types include

- Gross Margin Calculator: The difference between Sales and COGS.

- Net Margin Calculator: Factors in all costs, including taxes and operating expenses, so you have a clearer sense of your bottom line.

- Markup Calculator: Not strictly the same thing as profit margin, showing how much above the cost price you are selling is also very useful.

Each of these calculators does something a little different, but they all help you unravel the mystery of your business’s profitability.

Other Metrics to Monitor In Addition to Your Margin

The margin calculator is a great way to start, but it’s critical to track financial metrics outside of margin in order to fully grasp the health of your business. Some key metrics include

- Revenue sold: All the income.

- Operating Expenses: Amount of money it takes to run a business, inclusive of rent, utilities, and salaries.

- NET PROFIT: Lower figure on a set of accounts, what's left when you subtract all outgoings (taxes, interest, etc.).

- ROI (Return on Investment): Indicates how profitable your investments are.

FAQs

1. What is a m

Margin Calculator for Small Businesses

When you’re dealing with small businesses, the margin is often thin, which is why estimating your profit margin is vital. With the help of our margin calculator, entrepreneurs can easily see if their pricing is good enough and make the necessary changes if it’s not. It tells you at what level the lifeblood of your business—profitability—is running and prevents you from going broke.

How a Margin Calculator Assists in Pricing Decisions

Know your margins. Your margin affects your price. If your margins are narrow, you may have to increase prices in order to stay viable. On the other hand, if you have fat margins, you could have more leeway to discount or run promotions without compromising profit.

By entering a margin calculator, you can test multiple pricing scenarios at once to see which price point will optimally balance out profit on your products or services.

argin calculator?

A margin calculator is a tool that helps you find out the profit percentage you receive when selling a product and calculate the selling price based on the cost of the product.

2. How to use the margin calculator?

Just type your cost price (or COGS), your sale price, and your profit margin, and the price will be calculated instantly!

3. Why count my profit margin for the job?

It can assist you in good monitoring of your business's profitability. create a better pricing strategy help you make decisions based on data.

4. Are the margin calculator results correct?

Yes, Just fill in the actual cost and selling price, and you will get a true result.

5. Can the margin calculator be used for eCommerce?

Absolutely! The profit margin calculator is ideal for a company in the e-commerce sector in order to set the selling price of its own products.