How to Use Sales Tax Calculator

Table of Contents

What is a Sales Tax Calculator?

A sales tax calculator is a web-based program that allows both individuals and businesses to easily calculate sales tax based on a purchase or sale amount. By just entering the sale price of an item along with the sales tax rate, the sales tax calculator does the work for you and gives you the correct amount in no time. This way, you do not have to do any manual calculations, and there's no risk of making errors.

Why Do You Need a Sales Tax Calculator?

Sales tax plays a significant role in most transactions; it can be tricky to keep track of, especially if the tax rate changes based on location, product type, or service. Having a sales tax calculator, for example, makes that simple and easy and provides accurate results in much less time.

Businesses should use a sales tax calculator to ensure that they follow local tax laws to prevent making costly mistakes or handling tax situations later on. Consumers can also use a sales tax calculator to understand how much sales tax will apply to their purchase before they reach the checkout.

How does the sales tax calculator work?

The sales tax calculator takes two pieces of information: the price of the good or service and the tax rate. The sales tax calculator computes the sales tax using the following formula:

-

Tax Amount = Price × (Tax Rate ÷ 100)

-

Total Price = Price + Tax Amount

-

Price Before Tax = Total Price ÷ (1 + Tax Rate ÷ 100)

Once you enter a price and tax rate, the sales tax calculator returns the sales tax amount and adds that to the price of the item. For example, if you make a purchase that costs 100 dollars and your state sales tax is 7%. The sales tax would equal 7 dollars, making your total cost equal 107 dollars.

How to Use Sales Tax Calculator

Using the Sales Tax Calculator is very simple. Here is a simple step-by-step process for using the calculator:

Step 1: Visit the Tool

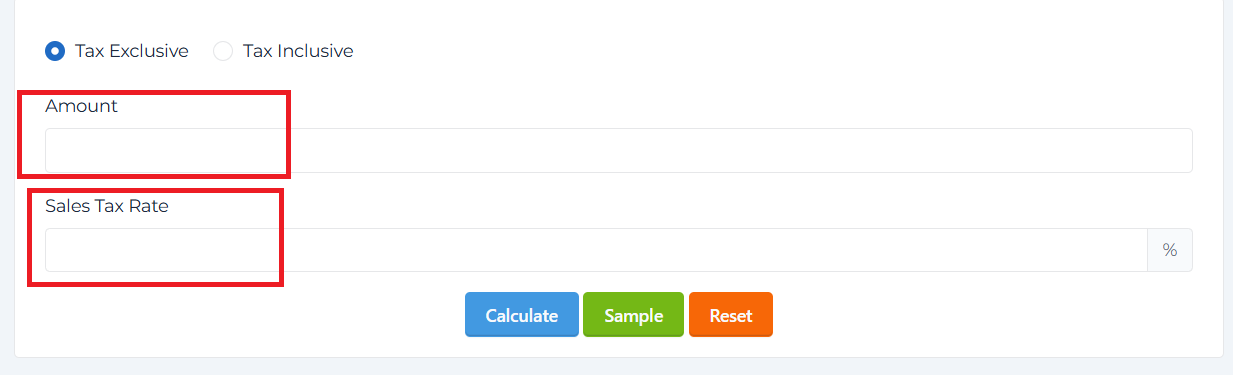

Step 2: Enter the Amount and Select the Tax Rate

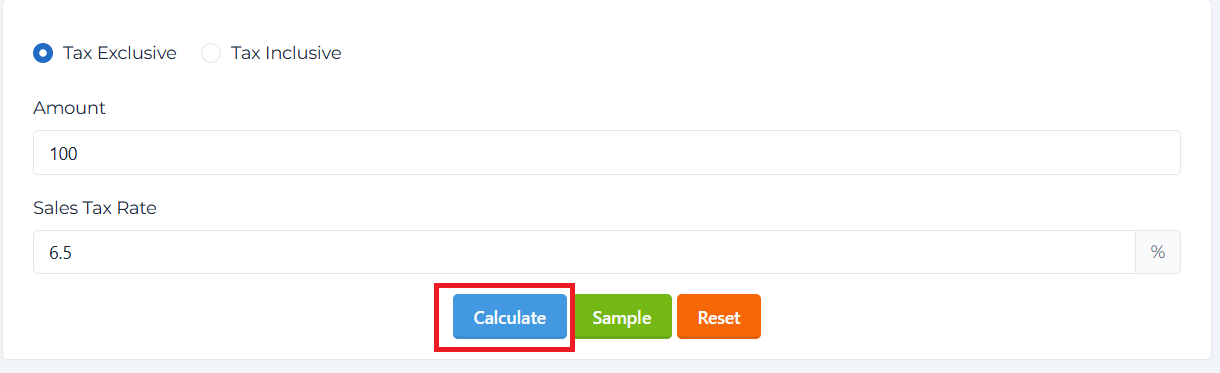

Step 3: Click The Calculate Button.

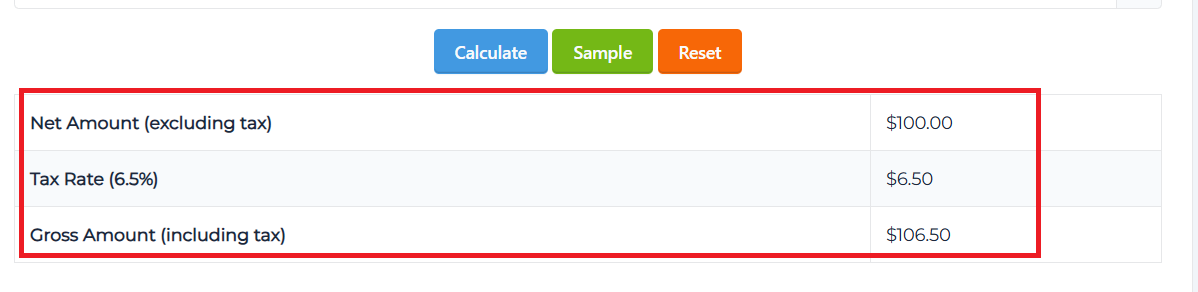

Step 4: View the result.

Advantages of using a Sales Tax Calculator

- Saves Time: Manually calculating sales tax can be time intensive with constantly variable rates; getting the calculator to do the work in seconds is nice.

- Same Level of Accuracy: Its automated calculation helps you to ensure there aren't any costly calculation errors, so you know you are getting the right tax amounts for sales.

- Stay Compliant: Businesses can stay compliant with local tax by avoiding the risk of underreporting for income taxes or overcharging in sales taxes and accounting for it.

- Convenience: Online calculators help ensure you can calculate sales tax wherever and whenever you want with just a mobile phone or computer.

Frequently Asked Questions

1. What is a sales tax calculator?

A sales tax calculator is an online application that provides a sales tax calculation for a product or service using the purchase amount and applicable sales tax rate.

2. Where would I find my applicable sales tax rate?

You can find your applicable sales tax rate on government websites or various retail websites based on your location and product type.

3. Could I use the sales tax calculator to calculate an international sales tax?

You could calculate international sales tax using the sales tax calculator; however, you will need to input the sales tax rate based off of the respective country or region's sales tax.

4. Is there a cost for the sales tax calculator to be used?

Most online sales tax calculators are free to use. This includes the one we provide on our website.

5. What if I enter the wrong tax rate when calculating my tax?

If you enter the wrong tax rate, it will result in an incorrect calculation of your sales tax. Please take the time to ensure that you have the correct tax rate for your area and the type of product you are calculating.